跨境電子商務(跨境電商)吸引著中國消費者

對外國產品的需求增加,新平台和政府的推動正在推動這一趨勢。

對外國產品的需求增加,新平台和政府的推動正在推動這一趨勢。

隨著中國的收入增加,其消費者加大了對進口商品的採購。但現在,不耐煩的最新產品和更好的價格,他們可以直接從外國零售商和提供者購買點擊滑鼠或螢幕的刷卡。

跨境消費電子商務在2015年估計為2510億人民幣(400億美元),佔中國消費電子商務總額的6%以上,並以每年50%的速度增長。

該國的主要電子商務網站,阿里巴巴的天貓,已經進入市場與跨境網站(天貓全球),較小的消費對手和初創企業,而美國電子商務領導亞馬遜在中國越來越活躍。

一些因素正在推動跨界趨勢(展覽)。中國中產階級和中上層階層的消費者正在尋求與中國尚未有的外國服裝和小工具交易,他們喜歡傳統的「磚塊或點擊」商家很少出售的利基產品。

此外,通過這種通路購買的海外進口商常常是昂貴的:例如,來自海外的嬰兒配方奶粉,受到富裕的中國父母的歡迎,通常成本高達美國或歐洲同一產品的兩倍。

跨境電子商務網站上的購物者也能獲得一定程度的保護,防止假冒或假冒商品,這些商品通常用於海外品牌,特別是二線城市和農村地區。

跨境電子商務(跨境電商)中國政府行動也是負責任的。為了阻止非法灰色市場進口,中國已經為個人使用物品的大量清單創造了10%到50%的優惠郵政稅 – 有時只是標準稅的一半。

(少於50新台幣的稅收通常被免除。)八個中國城市已經建立了適用於這種稅收制度的貿易區,更有可能這樣做,電子商務運動員已經加快了通過海關清關貨物的速度。

成立的物流運營商正在建設新的分銷通路,以應對不斷擴大的貿易。 Fengqu.com是順豐速運新的電子商務分拆,就是一個例子。

跨境電子商務(跨境電商)快速增長和日益激烈的競爭促進了聯盟和新戰略。

天貓國際吸引了主要的外國零售商,如美國的Costco和韓國的樂天瑪特,到其跨境網站。亞馬遜不僅最近向中國消費者開放了離岸購物網站,而且還向其中文網站(Amazon.cn)的使用者提供了具有中文描述和規格的精選外國產品的清單。

Rising demand for foreign products, new platforms, and a push by the government are propelling the trend.

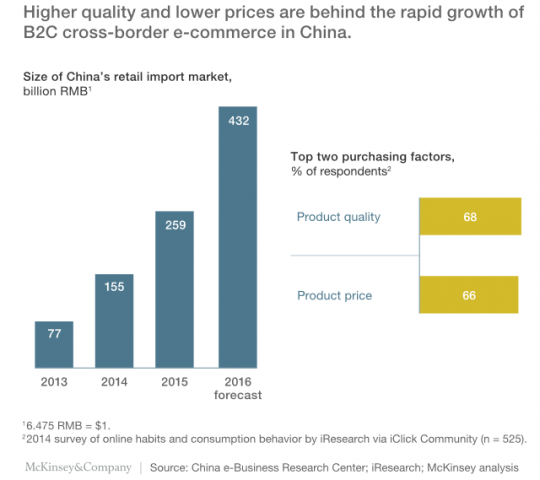

As incomes have risen in China, its consumers have stepped up their purchases of imported goods. But now, impatient for the latest products and better prices, they can buy directly from foreign retailers and suppliers at the click of a mouse or the swipe of a screen. Cross-border consumer e-commerce amounted to an estimated 259 billion renminbi ($40 billion) in 2015, more than 6 percent of China’s total consumer e-commerce, and it’s growing at upward of 50 percent annually. The country’s major e-commerce site, Alibaba’s Tmall, has moved into the market with a cross-border site (Tmall Global), as have smaller consumer rivals and start-ups, while US e-commerce leader Amazon is increasingly active in China.

A number of factors are fueling the cross-border trend (exhibit). Chinese middle- and upper-middle-class consumers are looking to trade up to foreign clothing and gadgets not yet available in China, and they like the niche offerings that traditional “bricks or clicks” merchants rarely sell. Overseas imports purchased through such channels, moreover, are often expensive: for example, baby formula from overseas, popular with affluent Chinese parents, often costs up to twice as much as the same product in the United States or Europe. Shoppers on cross-border e-commerce sites also feel some degree of protection from fake or counterfeit goods that often pass for offshore brands, particularly in second-tier cities and rural areas.

Exhibit

Government action is responsible, too. In an effort to stem illegal gray-market imports, China has created a favorable postal duty of 10 to 50 percent for a large list of personal-use items—sometimes as little as half the normal one. (Duty taxes of less than 50 renminbi are typically waived.) Eight Chinese cities have established trade zones qualifying for this tax regime, with more likely to do so, and e-commerce players have moved to speed up the clearance of goods through customs. Established logistics operators are building new distribution channels to handle the expanding trade. Fengqu.com a new e-commerce spin-off from SF Express, is one example.

Fast growth and rising competition are spurring alliances and new strategies. Tmall Global has attracted major foreign retailers, such as US-based Costco and South Korea’s Lotte Mart, to its cross-border site. Amazon not only recently opened its offshore shopping sites to Chinese consumers but also offers users of its Chinese site (Amazon.cn) a list of selected foreign products with Chinese-language descriptions and specifications.

This article is part of our series, China Pulse, which delivers insight into how digitization is reshaping China.